Accounting for Photographers Bundle

| Value | Discount | Savings |

|---|---|---|

| $70 | 50% | $35 |

Time Left To Buy

98 bought

The deal is closed.

The Fine Print

* Accounting for Photographers will email you download instructions within 48 hours of the deal close.* Works on Mac or PC

* Digital Download. No Refunds.

Highlights

- Accounting for Photographer Bundle includes the Snapshot Spreadsheet for Photographers ($45 Value) PLUS the Mileage Tracker ($25 Value).

- Organize business finances

- Track spending

- Easy-to-use tools

- Share:

- Tweet

-

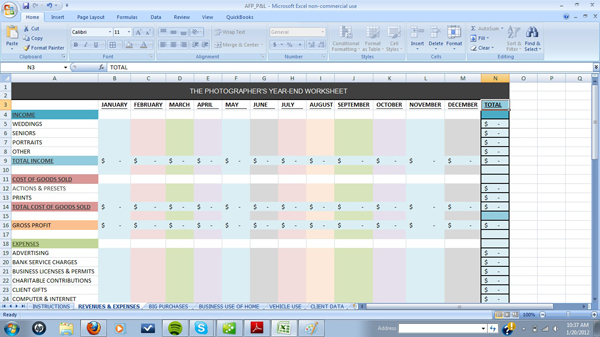

Tax-time doesn’t have to be daunting! It’s all about being organized – AND finding an easy-to-use product that works for you! These tools have been designed with you in mind – the photographer. They are CUSTOMIZEABLE, and can be used YEAR AFTER YEAR! Most photographers operate as Sole Proprietors or LLCs. If you don’t know what that means, you may want to check out my e-Workshop: Business 101: Setting Up Shop!

If you don’t pay employees, keeping financial records can be quite simple. While expensive financial-tracking software is a necessity for some businesses, most photographers will benefit from this inexpensive, user-friendly tool.

- Track income & expenses

- Have the math done for you!

- Gain a better understanding of your business finances

- Organize & consolidate your useful information

- Eliminate surprises at tax time

- Reduce the cost when paying your tax preparer

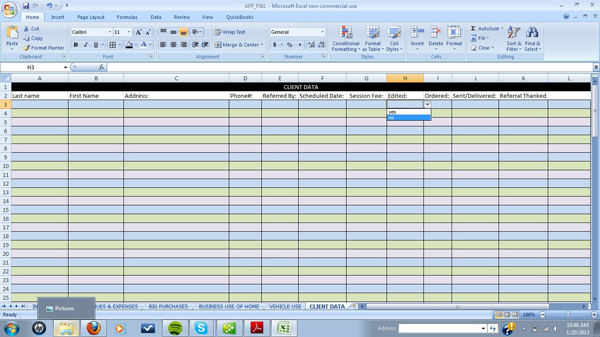

- NEW!!! Features a BONUS Client Tab to store Client Data

- Store client name, address & other contact info

- Drop-down tabs allow you to check tasks off your list of client to-dos such as editing, printing, mailing, etc.

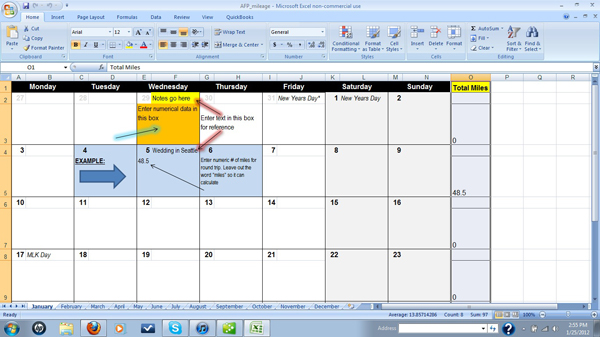

Mileage Tracker

Did you know you can receive a business deduction for miles you travel for business? Did you know that you have to keep written documentation to support that deduction? Purchase our MILEAGE TRACKER, an excel spreadsheet that will enable you to:

- enter daily, weekly, monthly & yearly trip totals into a custom-made calendar

- add notes about destinations

- stay organized

- skip doing the math!

- have the necessary documentation to support your deduction